Transaction Advisory Services

Inorganic growth can provide a much-needed boost to a company’s capabilities. However, India can be a challenging environment for concluding deals involving mergers, acquisitions and joint ventures, making it essential for such deals to be handled with great care and expertise. Investors must evaluate the accounting, tax, regulatory, legal, management and cultural aspects of the target company. While investors would like to have complete and accurate information to make critical decisions, such information is not readily available and is often difficult to evaluate. The success of a deal may hinge on the ability to discover and analyse the missing pieces. On-the-ground knowledge greatly improves the probability of a deal’s proper execution and success.

Inorganic growth can provide a much-needed boost to a company’s capabilities. However, India can be a challenging environment for concluding deals involving mergers, acquisitions and joint ventures, making it essential for such deals to be handled with great care and expertise. Investors must evaluate the accounting, tax, regulatory, legal, management and cultural aspects of the target company. While investors would like to have complete and accurate information to make critical decisions, such information is not readily available and is often difficult to evaluate. The success of a deal may hinge on the ability to discover and analyse the missing pieces. On-the-ground knowledge greatly improves the probability of a deal’s proper execution and success.

D & M’s holistic approach to Transaction Advisory comes from a thorough understanding of ground realities. We understand that it is not merely individual activities such as target identification or due diligence that determine the success of a transaction, but it is how such activities are collectively managed as a project. Our team is involved at every stage of the process followed by post-transaction hand-holding until our client is ready for the final handover. We work as project managers with our goal being the success of your business and its continued growth. We don’t work just as your advisers or consultants but more as your “Implementation Partners”.

Valuations

With the continuous revision of tax and legal doctrines and in-depth scrutiny of corporate transactions by tax and regulatory authorities, we specialize in Valuation services that integrate accounting, financial reporting, tax planning, corporate transactions, and regulatory compliances. We personalize our services with a focus on understanding the needs of the client, the transactions involved, and the perimeter of valuation.

With the continuous revision of tax and legal doctrines and in-depth scrutiny of corporate transactions by tax and regulatory authorities, we specialize in Valuation services that integrate accounting, financial reporting, tax planning, corporate transactions, and regulatory compliances. We personalize our services with a focus on understanding the needs of the client, the transactions involved, and the perimeter of valuation.

Our services include:

- Corporate transactions: We have extensive experience across several industries and are well versed with the techniques required for complex corporate assignments.

- Portfolio Companies (SEBI-registered AIFs): Under the SEBI (Alternate Investment Funds) Regulations, 2012, valuation of Category I and Category II AIF investments need to be performed at least once in six months.

- Regulatory requirements: Such valuation may be for the purpose of compliance with:

- Foreign Exchange Management Act (FEMA)

- Companies Act, 2013

- Rule 11 UA of the Income Tax Rules, 1962

- Swap certificates

- Overseas Direct Investment (ODI) guidelines

- Alternate Investment Fund (AIF) regulations

- Valuation of Intangibles: We also provide valuation support for intangibles such as the assessment of brand value, patents, trademarks, copyrights, goodwill, etc. Our services can help with:

- Financial reporting

- Transfer pricing matters

- Licensing agreements

- Mergers and acquisitions

- Financial transactions

Acquisition and Joint Venture Advisory

Deal Advisory

While trying to grow via the inorganic route, one of the greatest impediments to a successful transaction is failing to identify the correct partner. We believe that successful deals are those that result in a win-win situation for both the entities involved. With this end in mind, we assist our clients in assessing the strategic fit of a business by evaluating potential synergies, and identifying suitable partners or targets that would help achieve your long-term business objectives.

While trying to grow via the inorganic route, one of the greatest impediments to a successful transaction is failing to identify the correct partner. We believe that successful deals are those that result in a win-win situation for both the entities involved. With this end in mind, we assist our clients in assessing the strategic fit of a business by evaluating potential synergies, and identifying suitable partners or targets that would help achieve your long-term business objectives.

Our Deal Advisory team assists in transactions with various objectives such as mergers and acquisitions, joint ventures, management buyouts, divestitures, spin-offs and strategic alliances.

Even successful M&A transactions may have undergone difficulties at various stages. During the engagement process, we understand the possible issues that could lead to an unsuccessful deal and see how to prevent such deal breakers.

We conduct rigorous research and analyses to find the best fit. Our process includes:

- Understanding the client’s business and needs

- Providing a high-level market overview

- Conducting a deep dive analysis of shortlisted companies

- Providing decision-making, negotiation and legal/regulatory assistance

Our strong association with international trade bodies and networks across Europe, Asia and USA gives us a strategic edge. We work closely with various trade bodies in India as well.

Buy Mandate

Buying an existing business is the easiest way to get a head start in developing your market and growing your company. Cross-border M&As are a critical aspect of market development. When it comes to buying a business, it is critical to understand which aspects require the most time and attention; being well prepared will improve the quality of the transaction.

Our comprehensive services ensure that our clients do not make critical mistakes. At D & M, we help assess the business potential and focus on the underlying factors that lead to a successful acquisition. We help you decide your target market and screening criteria, identify the key value drivers and valuation range of your targets, understand how to structure the capital inflow, and maximise closure probability and expedite the buying process. In doing so, due consideration is given to cultural, legal, commercial, tax and exchange control aspects.

Our Approach

- Understand the business potential and develop screening criteria

- Screen targets

- Strategic evaluation of targets and initial feedback

- Initiate discussions between the buyer and seller

- Execution of the transaction and final handshake

- Smooth transaction closure

Sell Mandate

When you are looking to sell or divest your business, an adviser who knows the selling process thoroughly and understands the implications on your business is a key link. Our M&A advisers prioritise your objective for sale or divestment and structure the process accordingly. We are familiar with the costs, legal aspects, types of buyers and all other aspects concerning a sale.

We ensure that we convey your business potential and unique characteristics fittingly to potential buyers. In positioning your business, we consider the revenue synergies for the buyer and seek to maximise closure probability and expedite the sale process.

Our Approach

- Convey business potential to buyers

- Assess business value

- Screen and approach potential buyers

- Maximise deal closure probability

- Prepare seller for the sale

- Facilitate/coordinate for transactions and ensure timely closure

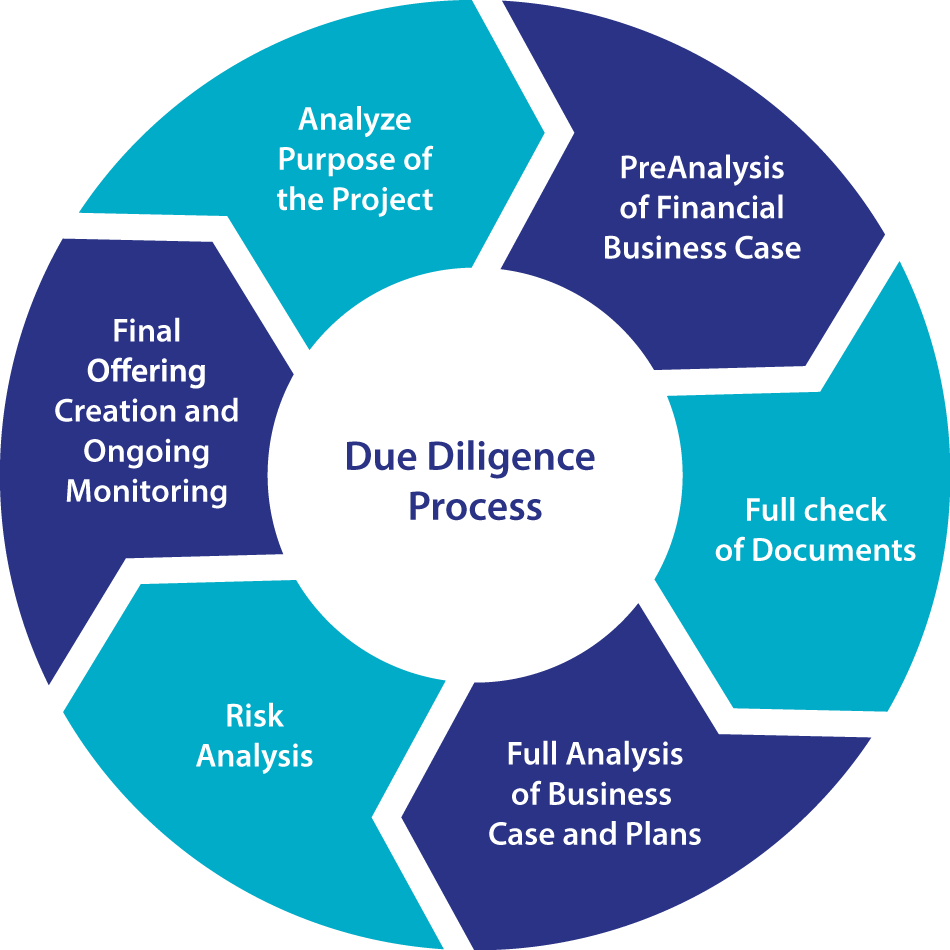

Due Diligence

Growth means change, and change involves risk. Stepping out of the known to the unknown always triggers the risk of failure, and to thrive with such risk, timely and accurate intelligence is a necessity. A professionally executed due diligence process equips investors, partners, as well as lenders with an effective and comprehensive snapshot that helps gauge not only financial risks but also organizational and reputational risks.

Growth means change, and change involves risk. Stepping out of the known to the unknown always triggers the risk of failure, and to thrive with such risk, timely and accurate intelligence is a necessity. A professionally executed due diligence process equips investors, partners, as well as lenders with an effective and comprehensive snapshot that helps gauge not only financial risks but also organizational and reputational risks.

- Financial and Tax Due Diligence

- Vendor Due Diligence

- Vendor Assistance and Dataroom Management

- Commercial Due Diligence

- Forensic Due Diligence

- It Risk Advisory And Compliance

Our buy-side due diligence services that help provide an insider’s view and comfort to decision-makers by analyzing and validating all financial, tax, and commercial parameters that need to be considered before finalizing a transaction.

Support to the buyer

- Managing the veracity of the information being shared by sellers’ management

- Highlighting unreliable indicators, quality of earnings, and normative debt positions

- Checking disparity in accounting principles and quality of financial information

- Exploring inadequacy of internal control, transparency, and corporate governance standards

- Ascertaining transparency of related party transactions

- Navigating complex and evolving tax regulations

- Providing aid to definitive agreements, representations, warranties, indemnities, disclosure schedules, and purchase price adjustment mechanisms

Our sell-side due diligence services help sellers prepare and position themselves better to meet the challenges posed by buyers during the acquisition process.

Support to the seller

- Identifying deal issues and developing negotiating positions

- Assessing proposed purchase price adjustments and earn-outs

- Training the in-house finance team to efficiently compile information for the investor

- Commenting on representations and warranties included in the purchase agreement

- Developing a workable purchase price mechanism to reduce the potential for disputes

- Resolving tax and accounting issues

Competition Policy and Analysis

The D & M team, led by Mr. Mandar Deshpande and in collaboration with major law firms, can assist your company in navigating through case-specific reviews and filings before the Competition Commission of India (CCI). In order to get transactions properly evaluated and expeditiously approved, the D & M team works closely with our client’s legal representatives to prepare a ‘competition assessment’ brief that is filed with the CCI.

The competition assessment brief focuses on the following areas:

- Merger and acquisition transactions

- Prohibition of anti-competitive agreements (alleged cartels)

- Monopolistic behaviour (abuse of dominant market position) and various competitive business practices.

Our experience in competition analysis spans across industries, including energy/petro-industrial chemicals, information technology (IT), automotive vehicles and parts, cement, and professional sports, among others.

Mergers & Acquisitions

It is widely recognised that M&A transactions are an important mechanism for business expansion, industry/firm restructuring and market entry. The ‘combination provisions’ of the Competition Act, 2002 require M&A transactions above certain size thresholds (based on assets or turnover in or outside of India) to be reported for review and clearance by the CCI. A transaction may be void if it is likely to cause an ‘appreciable adverse effect’ on competition in the relevant market in India.

Employing the latest industrial organisation methods, we present credible analyses of the nature and degree of competition prevailing in the relevant market, the business rationale for the acquisition, and whether or not the proposed transaction will adversely affect or increase competition. The team has prepared several competition impact briefs, and all the M&A transactions we have worked on have been cleared by the CCI well within 30 days, saving our clients significant monies in bridge financing and other costs.

Prohibition of Anti-competitive Agreements

Under the Competition Act, agreements between enterprises that result in fixing of prices, restriction of production, supply, distribution, storage, acquisition or control of goods or provision of services that cause or are likely to cause an appreciable adverse effect on competition are strictly prohibited. The fines levied by the CCI in such cases can be financially significant – up to 10% of the enterprise’s average turnover of the previous three years.

Unless there is evidence of overt meetings by businesses to engage in prohibited agreements and related practices, it is difficult to prove cartelisation of markets. Nonetheless, it must be noted that circumstantial ‘evidence’ such as parallel or similar pricing can be construed as being an illegal agreement.

At D & M, we conduct rigorous economic analyses to assess whether or not the allegations with respect to cartelisation of markets are plausible and credible, and draw distinctions between competitive and anti-competitive business behaviour. In this context, we analyse price patterns and variations, levels and dynamic changes in sales or market shares, ‘facilitating devices’ such as published price lists and contracts, and other relevant factors to ascertain if there is an alleged prohibited business arrangement.

Monopolistic Behaviour and Other Business Practices

It is not illegal for an enterprise to be ‘dominant’ or account for a large share of the relevant market. Indeed, enterprises are often larger than their competitors because of being more efficient and supplying higher quality products and services at competitive prices. However, ‘abuse’ of one’s dominant market position such as charging discriminatory prices, exclusionary behaviour, tied selling, predatory pricing and the like can constitute violations of the law. At the same time, ‘dominant’ enterprises can also become targets of complaints of alleged anti-competitive business practices by those who cannot compete effectively in the market place, or by industrial customers seeking to extract more favourable terms/conditions of sale and/or lower prices.

Given our extensive industrial experience and analytical capabilities, the team has prepared briefs on the ‘competitive dynamics’ of the relevant market, and the pricing and other constraints confronted by the alleged ‘dominant’ firm; the choice of alternative products and services from competing enterprises and demand elasticity; the nature and extent of barriers to entry, and if such barriers are firm- or market-specific, economic and/or strategic, or primarily determined by government policies and regulations, etc.

Transaction Structuring

We assist our clients in designing an optimal transaction structure taking into account the potential taxation, regulatory and capital structuring implications. We also handle any complexities that may occur during the execution of the transaction. We support different forms of entities in their opportunities for mergers, acquisitions, joint ventures, strategic alliances, demergers, divestment and reorganisation.

We assist our clients in designing an optimal transaction structure taking into account the potential taxation, regulatory and capital structuring implications. We also handle any complexities that may occur during the execution of the transaction. We support different forms of entities in their opportunities for mergers, acquisitions, joint ventures, strategic alliances, demergers, divestment and reorganisation.

The structure of a transaction can be complicated; while a particular structure may be beneficial for one party, it may not work for another. Therefore, identifying the best structure to consummate the transaction is critical. In our approach to transaction structuring, understanding client expectations before suggesting the optimal deal structure is our priority.

Transaction structuring would largely involve matters that impact the company’s capital structure, deal structure, tax considerations and regulatory framework. Based on our client’s requirements, our offerings are as follows:

- Capital Structuring: Source of finance such as debt, equity, bridge loan, ECBs, etc.

- Tax Structuring: Deciding on an optimal structure that is tax-efficient across jurisdictions

- Deal Structure: Mode of transaction that includes decision-making on slump sale, asset sale or share purchase

- Regulatory Advisory: Considering FEMA, company law and other related legal issues while deciding on an optimal structure

In this process, our approach will be as follows:

- Understand the primary objectives of the parties involved in the transaction

- Implement an efficient way of sharing risks collectively by both the parties to create a win-win situation

- Determine the high-level/critical issues impacting the transaction as a whole

- Prioritise the critical issues affecting both parties in order to optimise the structure

- Evaluate deals already executed in the past and provide appropriate recommendations

- Evaluate other available alternatives over the suggested deal structure considering the above parameters.

Restructuring

Growing opportunities for foreign direct investment and strategic alliances in India have increased the need for transaction advisory and restructuring services. Constant examination of your business practices and structures is necessary to ensure continual improvement, essential to flourish in today’s dynamic world. At D & M, we ensure that your company is operating in the most efficient manner, not merely from a tax point of view, but more importantly, from the overall business perspective.

Growing opportunities for foreign direct investment and strategic alliances in India have increased the need for transaction advisory and restructuring services. Constant examination of your business practices and structures is necessary to ensure continual improvement, essential to flourish in today’s dynamic world. At D & M, we ensure that your company is operating in the most efficient manner, not merely from a tax point of view, but more importantly, from the overall business perspective.

We have extensive experience in compliance under various Indian statutes viz. direct and indirect taxes, FEMA regulations and corporate laws. With our team of experts, we are capable of creating an efficient structure and ensure that our clients mitigate financial and legal risks.

The need for restructuring may arise from various external and internal factors.

External factors could include:

- Business expansion (mergers, acquisitions, and joint ventures)

- Business divestment (demerger or stake sale)

- Higher returns for business through disposal of non-core assets (itemised sale, slump sale, demerger)

Internal factors could include:

- Enhancing business performance

- Tax planning

- Consolidation/separation of the business

- Unlocking the value of the business

- Family business reorganisation – division/dispute resolution/succession

- Profit repatriation

- Business closure/winding up

At D & M, we provide a complete suite of financial and strategic advisory services in a manner that helps you drive transactions in the most efficient and effective way. While working as your partner, the D & M approach is that of a Project Manager providing an end-to-end solution. Right from the planning phase to the implementation and post-implementation phase, we are involved throughout the life cycle of the transaction.

We can help your business with the following:

- Advise on the most favourable holding company jurisdiction

- Choose the entity for carrying out business in India

- Identify optimal capital structures and financing strategies i.e. debt vs equity to ensure quicker and tax-efficient repatriation of funds

- Ensure that the restructuring is compliant with all regulations

- Assist in planning, scheduling and monitoring the restructuring programme (capital reduction, buyback of shares, dividend option, reorganisation/structuring of capital, conversion of entity, etc.)

- Identify and resolve legal issues with the help of lawyers

- Liaise with regulatory authorities

- Identify and implement the most suitable form of business closure (member’s voluntary winding up, fast-track exit/deregistration, winding up by a court, creditor’s voluntary winding up).

SERVICES

- Consulting Services

- Strategic Initiatives

- Operations Transformation

- Transaction Advisory

- Business Services

- Business Process Management

- Corporate Services

- Professional Services

- Taxation

- Assurance & Risk Advisory